COVID-19 and Texas Employees: Layoffs, Severances, Commissions, Paid Leave, and Unemployment

Here is what Texas workers need to know as of March 19, 2020 about Coronavirus affecting Texas layoffs, severances, commissions, paid leave, and unemployment.

LAYOFFS

Layoffs are coming. Some are already here. It is too early to tell how many to expect, but the State of Texas has issued a disaster declaration.

Texas companies have the right to lay off workers, subject to some exceptions. Businesses violate the law if they have laid-off Texas workers because they are pregnant, or because of their race, color, religion, national origin, gender, veteran status, age (over 40 only), or because they made a protected complaint (e.g., whistleblowers who report financial fraud, healthcare fraud, healthcare safety violations, or oppose sexual harassment or gender or race discrimination).

The WARN act also applies to certain layoffs like plant closings and mass layoffs, and WARN requires employers to provide 60 days of notice before the layoff. However, there is an “unforeseen circumstances” exception to WARN requirements that might be triggered by the novel coronavirus – it will depend on the facts and circumstances of the layoff.

Was your layoff illegal? There is no easy answer. In general terms, if a company lays off all workers or an entire division or class of workers (e.g., every single nail technician or every single server) because of COVID-19, and has not violated the WARN act, that layoff is painful but not likely not illegal. On the other hand, if the layoff hits only selected employees, or severance packages are offered to only select employees, that may be evidence of discriminatory conduct which may violate the law.

EXECUTIVES

If you are a Texas executive or otherwise have an employment contract, your employer is required to follow the terms of your contract. Many Texas executive contracts do not have force majuere clauses or any clauses that makes exceptions for an outbreak like this, meaning that if the firm tries to fire you because of outside circumstances that may not constitute a “for cause” firing under your contract, and you may be entitled to your pre-negotiated severance amount or some amount to make up for the breach of your employment contract.

SEVERANCE

Surprisingly, Texas businesses are not generally required by law to pay a severance in the event of layoffs. Most do as a matter of practice. Also, if there is a company policy stating employees are entitled to severance payments, or if the severance is pre-negotiated into contracts, the employer will have to pay it.

Employers cannot discriminate in determining how much severance to pay (e.g., cannot pay similarly situated men more severance than women because of their gender).

Severance agreements, like any contract, are 100% negotiable. Whether and what to negotiate is a fact-intensive inquiry. Some employees may also need to negotiate non-compete or non-solicit agreements that they signed earlier to give them more space to find replacement employment.

COMMISSION PAYMENTS

The law on Texas commission payments for folks like Austin software sales employees, including outbound sales, inbound sales, and sales engineers is complicated. Texas law tends to defer to your commission agreement. If you do not have a written commission agreement, the law will defer to your verbal agreement and consider the course of dealing.

Whether and how much commission the company owes you after a layoff or termination or wrongful termination is often a disputed issue. Sometimes there are hundreds of dollars in dispute, sometimes thousands, and sometimes hundreds of thousands or more. We recommend no matter the amount you are owed, calling a Texas sales commission lawyer to understand and enforce your rights.

PAID LEAVE

Shockingly, in 2020 most Texas workers are not entitled to paid sick leave absences. In Texas, only the City of Dallas currently has a paid sick leave ordinance in effect. Although it is unpaid, workers at companies with 15 or more people have the right to keep their job if they need leave for disabilities (under the Americans with Disabilities Act) and workers at worksites with 50 or more employees have the right to protected leave for serious health conditions under the FMLA (the 1993 Family and Medical Leave Act). But, neither of these laws require leave to be paid. Employers will often have their own paid leave policy and pay it by choice, and/or provide short or long-term disability insurance coverage that may apply (although short term disability coverage often provides only 2/3 of your pay).

None of this is particularly helpful in addressing the coronavirus pandemic upon us, during which hard-working Texans will get sick and we all need them to stay home without losing both their jobs and their paychecks.

So, this week, the United States Congress passed the extraordinary H.R. 6201, FAMILIES FIRST CORONAVIRUS RESPONSE ACT. This law is brand new. Here is an explainer of what it purports to do, here is another, and here is the bill.

The new law takes effect April 2, and provides emergency paid sick leave for 2 weeks at your regular rate of pay (capped at $511 a day or $5,110 total) if you are quarantined or seeking a diagnosis for COVID-19, and 2 weeks of paid leave at 2/3 your regular rate (capped at $200/day or $2,000 total) if you are caring for a family member who is quarantined or dealing with COVID-19 or caring for children whose school or childcare is closed due to COVID-19.

For some reason (presumably lobbying), these new emergency paid leave provisions apply only to companies with fewer than 500 employees, so big businesses are exempt from paid emergency leave for now. Covered employers will pay wages during the leave, then receive tax credits designed to cover the cost of the paid leave.

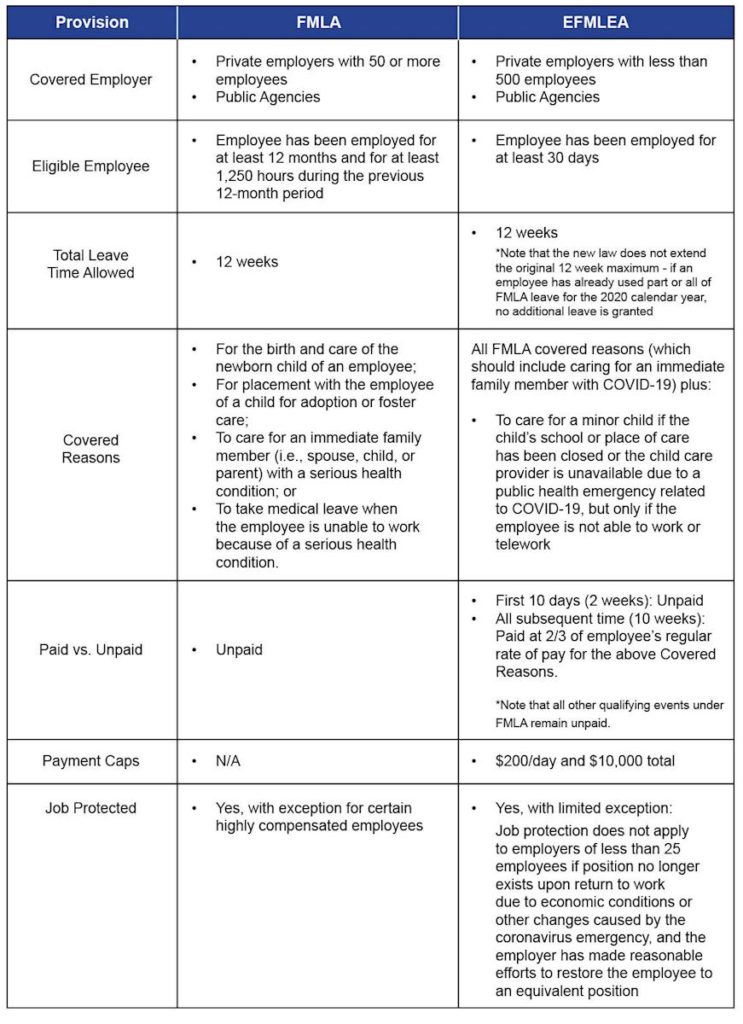

3/20/20 UPDATE: here is a helpful chart, prepared by our colleague Dan Schwartz in Connecticut, laying out the differences between FMLA and the new EFMLA:

If you are sick, do NOT come to work. Employers: you are currently permitted to take employees’ temperatures to ensure the safety of the workplace, and are permitted to force employees who are a direct threat to the safety of themselves or others to stay home until they are not a direct threat.

UNEMPLOYMENT

If you are in a reduction in force (RIF) because of corona virus, and you are otherwise qualified, you will probably be entitled to receive unemployment benefits. Texas employees in a layoff are, under most circumstances, entitled to receive unemployment benefits. The Texas Workforce Commission administers those benefits for Texans. As of today, the TWC states:

“TWC will be waiving work search requirements for all claimants and the waiting week for those claimants affected by COVID-19. Also, Extended Benefits (EB) and Disaster Unemployment Assistance (DUA) are NOT available at this time. “

In other words, if you qualify TWC will pay you benefits almost immediately (instead of waiting a week) and you do not need to immediately look for other work, but all other requirements are the same. Be sure to check the TWC website, we expect updates.

Our general suggestion for employees is to apply for unemployment benefits as soon you lose your job. If you have a negotiated severance agreement that waives certain legal claims, you may be eligible to receive payment under that agreement at the same time as you receive your unemployment benefits. Consult with a qualified Texas severance negotiation lawyer for more details about this.

We hope this post has some helpful information for our Texas community. There will be a light at the end of this tunnel. Stay safe, stay calm, stay home if you can, and flatten the curve.

*Nothing in this blog post is, should be considered, or should be substituted for legal advice. If you need legal assistance, consult with a lawyer.